Industrial transfer under tariff hijacking, a lose lose dilemma

Created on 2025.10.29

In the past two years, too many customers have transferred their orders to Southeast Asian countries, especially large brand import wholesalers, whose customs data includes VNVNVNVNVN, MYMYMY, and INININ. ”

The factories on a street in Vietnam doubled at the end of last year, and as soon as they arrived, they were competing for workers' wages.

I'm sorry, but it seems that you haven't provided any source text for translation. Please provide the content you'd like me to translate, and I'll be happy to assist you!

In recent years, the transfer of industrial chains and the "southeast flight" of European and American orders have become an unavoidable "heartache" for Chinese foreign trade personnel.

What is the trend of global industrial chain transfer? Which industries have been transferred? Where did it transfer to? Why transfer? How can Chinese foreign trade personnel avoid being "thrown off the train" and even catch up with the new fast train?

1、 What is the real situation of industrial transfer?

The industrial transfer that we often talk about actually needs to be viewed separately.

- Overall: International industrial chain transfer

In March of this year, the CEO of HP stated, "It is expected that by the end of this fiscal year, less than 10% of goods sold in North America will come from China, which means that more than 90% of goods will be produced outside of China."

In fact, it's not just HP. Earlier, companies such as Apple, Samsung, Dell, and Sony have all relocated some of their production capacity.

Where has the industry shifted to?

The 2025 World Investment Report released by the United Nations Conference on Trade and Development shows that Southeast Asia, Eastern Europe, and Central America have become the main beneficiary regions in the context of global production base restructuring by multinational corporations.

Especially in the East Asian region, although China's foreign investment inflow declined for the second consecutive year in 2024, with a decrease of 29%, the scale of investment attraction in ASEAN countries reached 225 billion US dollars, a year-on-year increase of 10%, reaching a historical high.

Taking our neighbor Vietnam as an example, its top ten export enterprises are as follows:

Image source: Produced by Futong Tianxia Cloud Platform (authorized)

More than half of the top ten Vietnamese exporters are foreign-funded enterprises, such as Samsung from South Korea, Intel from the United States, LG Group from South Korea, and Foxconn from Taiwan.

2. Local: China's industrial transfer

In recent years, more and more Chinese bosses have chosen to go abroad to build factories.

According to feedback from foreign trade professionals:

My boss's factory is located in Cambodia, mainly accepting orders from European and American brands such as Gap, Zara, Walmart, and GU. Recently, there has been a surge in orders, and our own factory is unable to complete them. We can only outsource to other factories in Cambodia, but we didn't expect those factories to be unable to do so due to the surge in orders.

Many factories in our small county town have also moved there. I heard that the treatment given after going there is even better than here, and workers cannot be easily exploited there. Sometimes I really feel that our own people are more cruel to our own people.

The downstream manufacturers I am in contact with have already shut down all their domestic production lines and are working overtime in Cambodia to produce and sell their goods to the United States - after all, the tariffs there are low

Nowadays, factories in Southeast Asian countries such as Vietnam are basically fully operational in order to seize the market gap during the China US tariff war. Many American customers are also actively seeking cooperation with suppliers in Southeast Asia.

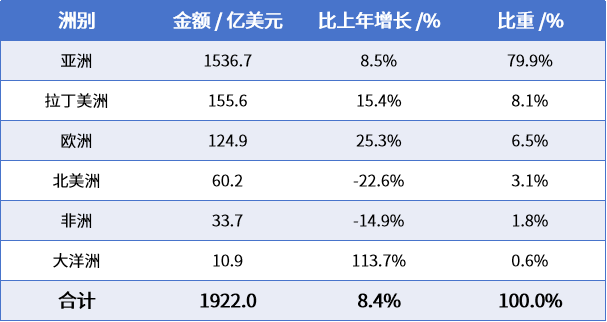

According to the 2024 China Outward Foreign Direct Investment Bulletin, the regional composition of China's outward foreign direct investment flows is as follows:

Image source: Produced by Futong Tianxia Cloud Platform (authorized) Data source: 2024 China Outward Foreign Direct Investment Bulletin

In 2024, China's direct investment flow to ASEAN reached a historical high of 34.36 billion US dollars, an increase of 36.8% over the previous year and accounting for 17.9% of the total flow for that year.

The first target industry for investment in ASEAN is the manufacturing industry, which has reached 15.39 billion US dollars, an increase of 68.2% over the previous year, accounting for 44.8%, mainly flowing to Thailand, Indonesia, Vietnam, and Singapore.

According to an article in The Economist, the most likely destination countries to undertake China's industrial relocation are:

Asia: Vietnam, Malaysia, Thailand, Indonesia, India;

Americas: Mexico, Brazil;

Eurasian border: Türkiye.

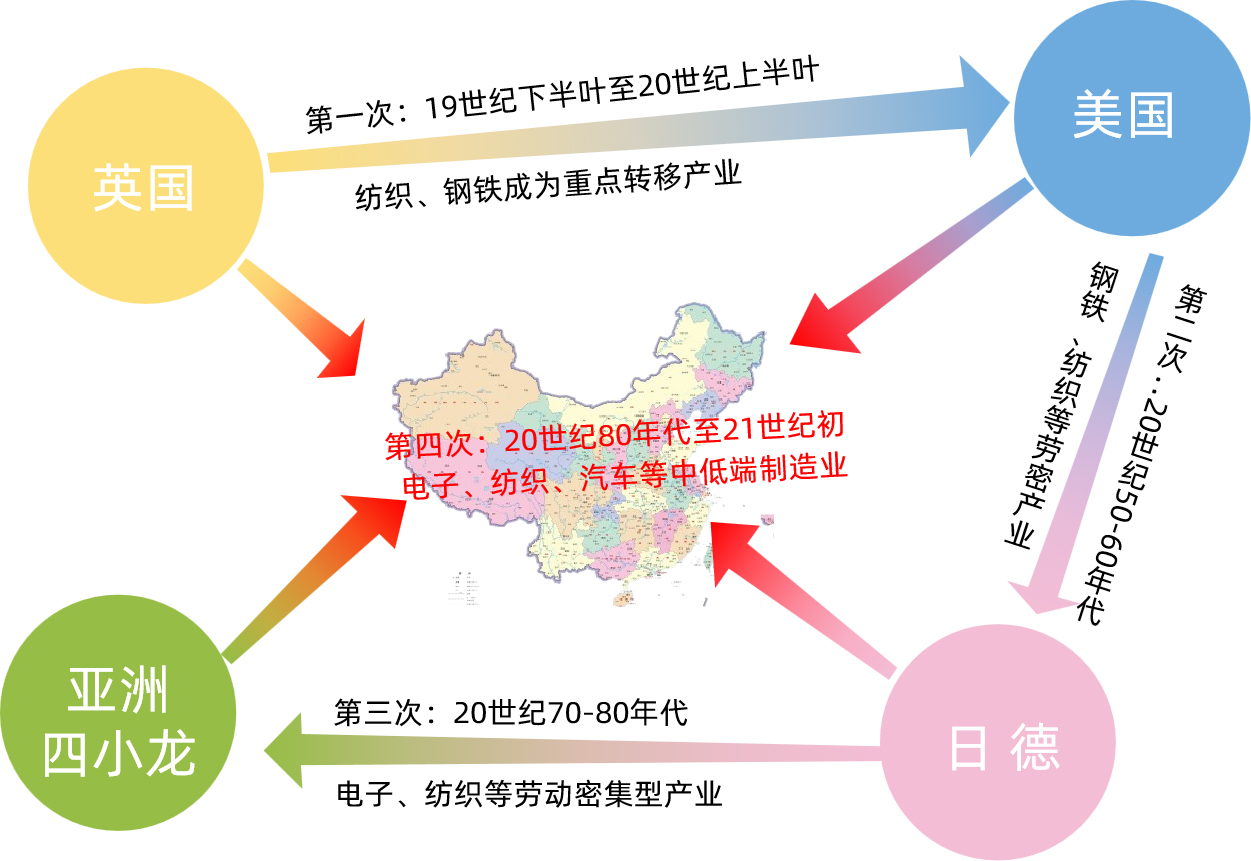

2、 Why do we need to carry out industrial transfer?

Normally, with factors such as industrial upgrading, rising labor costs, and environmental protection requirements in a country, there will inevitably be industrial transfer: low-end industries will inevitably migrate to labor-intensive areas.

There have been four migrations in history:

United Kingdom → United States;

United States → Japan, Germany;

Japan, Germany → Asia's "Four Little Dragons" (Hong Kong, Taiwan, China, Singapore and South Korea) and some Latin American countries;

Developed countries such as Europe, America, Japan, and emerging countries such as the "Four Asian Tigers" → China.

Image source: Produced by Futong Tianxia Cloud Platform (authorized)

Currently, some industries in China are shifting to Southeast Asian countries.

After all, if you were the owner of a clothing or footwear industry and the wages of Vietnamese workers were reduced by half, who would you choose?

However, such industries are often labor-intensive and low tech industries (such as clothing, shoes, and hats), which do not require much industrial chain support and have low profits. The level of worker wages largely determines the level of profits.

What is truly alarming is:

Tariffs and geopolitical risks are increasingly becoming the primary driving factors for foreign companies to adjust their industrial chains; Countries such as the United States and Europe do not transfer or place orders, forming a "bundled" industrial chain relocation.

Why do you say that?

The transfer of labor-intensive industries is understandable, but many capital intensive industries are also gradually shifting.

You should know that cost cannot be solely based on labor costs, but also on the overall supporting infrastructure of the entire industry chain. China has the most complete range of industrial sectors in the world, making it the place with the richest wealth.

The actual feeling of foreign trade personnel is also the same:

Those who boast about the good working environment in Vietnam have never been to Vietnam. I have been there. Vietnamese workers' wages have risen rapidly in recent years, mainly because labor organizations have played a role. Because most of Vietnam's factories are foreign-funded, the country doesn't seem to manage them much. I remember when we were making buttons in Shenzhen in 2014, the average worker's salary in Vietnam was only about 1200-1500 yuan, and now it is close to 2800 yuan. This wage level seems to be nearly half lower than China, but Vietnam's "three connections and one leveling" (water, electricity, road, and site leveling) are still too poor. Power outages are commonplace, and roads, railways, and highways are not developed. Therefore, employment opportunities are still concentrated in industries near ports until now. There are quite a few parks.

Their costs are even higher than in China, for example, rent is more expensive in many places than in Shenzhen, labor efficiency is only 70% of that in China, and transportation costs are at least 30% higher. But there is no other way, foreign companies demand to withdraw, and these suppliers and Chinese enterprises must go overseas to build factories, otherwise they will be eliminated.

Our boss has opened a factory in Thailand, and apart from cheap labor, all other costs are higher than in China. Even the nozzle pens have to be bought and brought over from China, let alone anything else.

According to Boston Consulting Group's calculations, the average annual net profit consumed by a company restructuring its supply chain is 18%; Some public data in the United States shows that the prices of "Chinese substitutes" from Vietnam and Mexico are about 9% -15% higher.

Therefore, the transfer of these industries does not comply with cost factors.

Image source: Photo Network (authorized)

In recent years, the United States has been taking continuous actions, repeatedly raising taxes and imposing sanctions, forcing multinational corporations to make a "painful but necessary choice": to reduce their dependence on China through means such as industrial transfer.

This has forced some upstream and downstream suppliers in the industry chain to "passively" or "follow" overseas. For example, after the relocation of mobile phone brands, assembly or component manufacturers represented by Foxconn often move along.

At the same time, many Chinese companies are also facing transfer difficulties:

Our company's Vietnam factory started construction in June, but we haven't given up on the domestic market. Let me tell you why we want to go to Vietnam, it's actually because of the needs of our customers. Some foreign customers want their orders to be produced in Vietnam.

Our boss has also established a factory in Vietnam. I heard that currently, raw materials are transported from China, which means the cost is higher than in China. However, the customer requires that there must be a factory abroad to produce goods.

Our major American client has given us an ultimatum to transfer orders to someone else if we don't build a factory in Southeast Asia. So, should we go to Southeast Asia to build a factory? Currently, we are under a lot of financial pressure. This American client has about 10 million orders a year. If we don't do this client's orders, we will lose a quarter of our revenue in a year. After calculating the cost of building a factory, it will take about 5 to 10 years to recoup our investment.

But building a factory abroad is definitely not that simple. Whether there is profit on their land is also a matter of their words. You can refer to international giants such as Amazon, Coca Cola, Samsung, Xiaomi, etc. that have invested in India and failed to succeed.

3、 Where should Chinese foreign trade enterprises go from here?

The transfer of industries has a direct impact on foreign traders who adhere to domestic production and traditional models: loss of orders, decreased price competitiveness, and customer loss.

What should Chinese foreign trade enterprises do? It's actually difficult to come up with a foolproof solution, but there are several directions to consider.

- Deeply cultivate the domestic industrial chain and transform towards "high value"

China has a complete industrial chain, high-quality workers, and complete infrastructure, which are advantages that Southeast Asia cannot replace in the short term.

Enterprises should gradually increase the added value of their products and get rid of low price competition. This will inevitably bring short-term pains, but due to the situation, we can only break through upwards:

Technology driven: Increase research and development investment, master patents and industry standards, and improve product added value. For example, shifting from producing clothing to developing high-performance fabrics.

Service oriented transformation: providing customers with a comprehensive solution of "product+service", extending the industrial chain, and improving service quality. For example, extending from selling equipment to selling maintenance, data, and performance.

2. Proactively go global and layout overseas production capacity

Instead of passively waiting for orders to be lost, it's better to proactively go out to sea. After in-depth investigation, establish branch factories or cooperative bases in Southeast Asia, Mexico, Eastern Europe and other regions. This can not only be close to the market and avoid tariffs, but also leverage the local labor cost advantage to serve regional customers.

3. Explore new markets and reduce dependence on Europe and America

Although European and American orders are important, emerging markets such as the "the Belt and Road" countries, the RCEP region, the Middle East, and Latin America are growing rapidly. Chinese enterprises should actively expand diversified markets, diversify risks, and seek new increments.

Translated from Cross border Knowledge - Futong Tianxia

Contact

Leave your information and we will contact you.