Spending 200 million yuan to acquire land and build buildings, Saiwei Era accelerates its digital layout and goes global

Created on 2025.10.27

1. Building a new building and developing technology

No matter what the purpose is, buying land is a symbol of strength.

In cross-border e-commerce districts, the purchase of land by enterprises not only reflects their comprehensive strength, but also demonstrates their confidence in future development. After all, land is real estate, and cross-border trade is constantly changing. Without the ability to count money, it is difficult to take a risk.

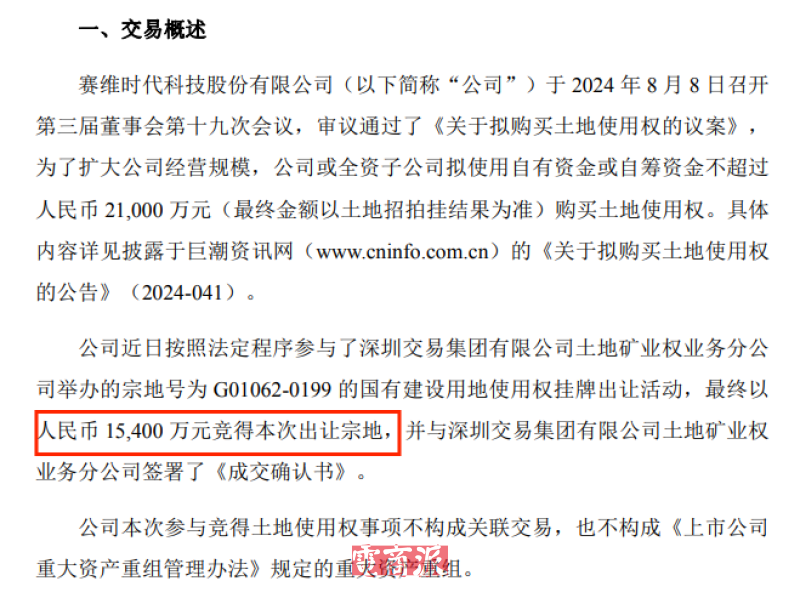

In Shenzhen, where every inch of land is precious, the clothing giant Saiwei era demonstrated its hardcore "money making ability". According to the latest announcement from Track Times, the company participated in a state-owned construction land use right listing and transfer activity in accordance with legal procedures, and ultimately won the bid for the land parcel for RMB 154 million.

Savi Era buys maps in Shenzhen Source: Juchao Information

In detail, this land is located at the junction of Longcheng Street and Yuanshan Street in Longgang District, Shenzhen. It belongs to the core area of the region, with convenient transportation, a land area of 26863.91m², a building area of 139298m², and a service life of 30 years.

According to the planning of Saiwei Times, this land will be used to build the "Global Innovation and Digital Operations Center" project, enhancing the company's comprehensive capabilities in product research and development, brand incubation, supply chain management, and digital operations, further consolidating its market competitiveness.

Obviously, Saiwei Era is full of confidence in its business prospects. Buying land is a small matter, and the future productivity that can be created is the focus of investment. According to the expectations of Saiwei Times, the original plan was to spend no more than 210 million yuan, but now it seems that there is still a considerable surplus after buying the land.

Of course, this 'cash capability' is not due to strong winds. Behind the confidence of the Saiwei era's heavy land purchases is the steadily rising sales performance. According to the financial report of Saiwei Times, the company's revenue in 2024 entered the billions for the first time, reaching 10.25 billion yuan, a year-on-year increase of 56.55%; In the first half of 2025, the revenue was 5.346 billion yuan, a year-on-year increase of 27.96%.

Saiwei Era's revenue exceeds 10 billion yuan. Source: Saiwei Era

Recently, Saiwei Times also released a draft of the 2025 restricted stock incentive plan, which plans to grant 4,034,582 restricted stocks to some employees, accounting for approximately 1.00% of the company's total share capital. And the initial grant price is 11.03 yuan/share, which is 50% lower than the market price. That is to say, incentivized employees can purchase company stocks at a 50% discount, which is equivalent to Savi Era giving 44.5 million yuan to employees.

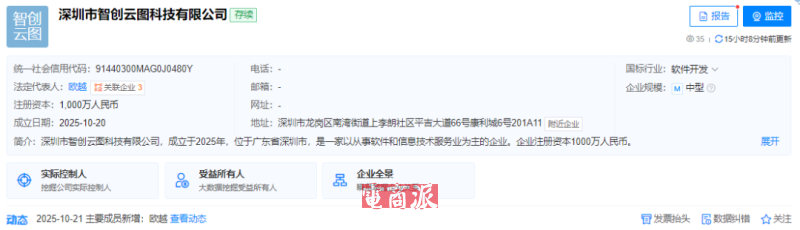

Recently, Savi Era has just established an AI subsidiary. According to public information, the company is named Shenzhen Zhichuang Cloud Cloud Technology Co., Ltd. with a registered capital of 10 million yuan. Its business covers AI related software development, application software development, application system integration services, and more.

Saiwei Era establishes AI subsidiary Image source: Tianyancha

All these actions indicate that Saiwei Era is gradually upgrading its strategy, implementing layout in various aspects such as business expansion and employee motivation. It can be foreseen that as its pace of going global accelerates, these strategies will inject stronger development momentum into it in the future.

II. Accelerating the impact on higher growth

Although the overall business development is good, being on the red ocean track, the arrival of the Saiwei era is not easy.

Initially, Saiwei Era started with a distribution model, selling a variety of products such as clothing and home furnishings through e-commerce platforms to quickly open up the market. But with the development of the industry, the distribution mode is gradually fading, and the competitiveness is weakening. The Saiwei era is facing the challenge of transformation.

Therefore, in 2016, Saiwei Era began to focus on building its own brand, gradually shifting from distribution to brand operation, emphasizing product development, and enhancing the overall competitiveness of the company by improving brand influence.

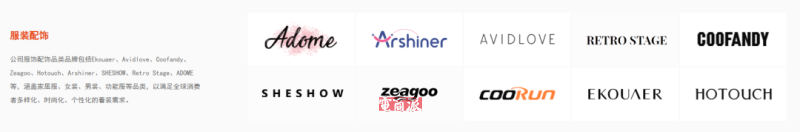

At present, focusing on the clothing industry, Saiwei Times has successfully incubated multiple self-owned brands. Moreover, these brands continue to perform well, not only becoming the main revenue driver of the Saiwei era, but also a key driving force for overall performance growth.

Source of Saiwei Era Brand Matrix: Saiwei Era

In 2024, both the men's clothing brand Coovandy and the home clothing brand Ekouaer achieved annual sales exceeding 2 billion yuan, maintaining a leading position in the Sevidor brand matrix; The annual revenue of lingerie brand Avidlove, women's clothing brand Zeagoo, and children's clothing brand Arshiner reached 870 million yuan, 560 million yuan, and 340 million yuan, respectively.

In addition, in other clothing and new product categories, Saiwei Times has more than ten brands with annual sales in the billions and over 70 brands with annual sales in the tens of millions.

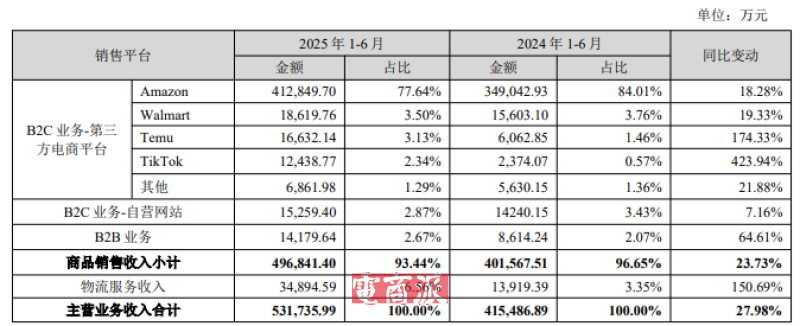

At the same time, Saiwei Era is actively expanding its channel distribution and improving its overall risk resistance capability. Data shows that in the first half of 2025, the emerging channels of Saiwei Era will grow rapidly, with Temu platform revenue increasing by 174.33% year-on-year, accounting for 3.13%; The revenue of TikTok Shop platform increased by 423.94% year-on-year, accounting for 2.34%.

Source of revenue data for various channels in the Saiwei era: Juchao Information

In addition to focusing on channels and brands, Saiwei Era also emphasizes the application of new technologies, striving to always be at the forefront of the industry. For example, through self-developed supply chain systems, the linkage between raw material configuration, production, and sales can be achieved to improve supply chain efficiency. By utilizing full chain digital capabilities such as pattern databases and flexible supply chain ERP systems, we can quickly respond to market demand, enhance business stability, and improve risk resistance.

Overall, Saiwei Era continues to tap into its own and market potential, and its business success is expected to continue in the long run. Although these significant actions may bring short-term pressure, such as the fact that from last year until now, Saiwei Times has increased revenue without increasing profits. But in the long run, to reap more, one must inevitably put in more effort. Only by solidly implementing every step can we have a chance to reach the peak.

Contact

Leave your information and we will contact you.