How many orders do American consumers need to buy with the imminent implementation of 'equivalent tariffs'? Yale team calculates accounts

Created on 2025.08.08

On August 4th Eastern Time, the US Customs and Border Protection (CBP) released the implementation details of Trump's adjusted "reciprocal tariffs" executive order.

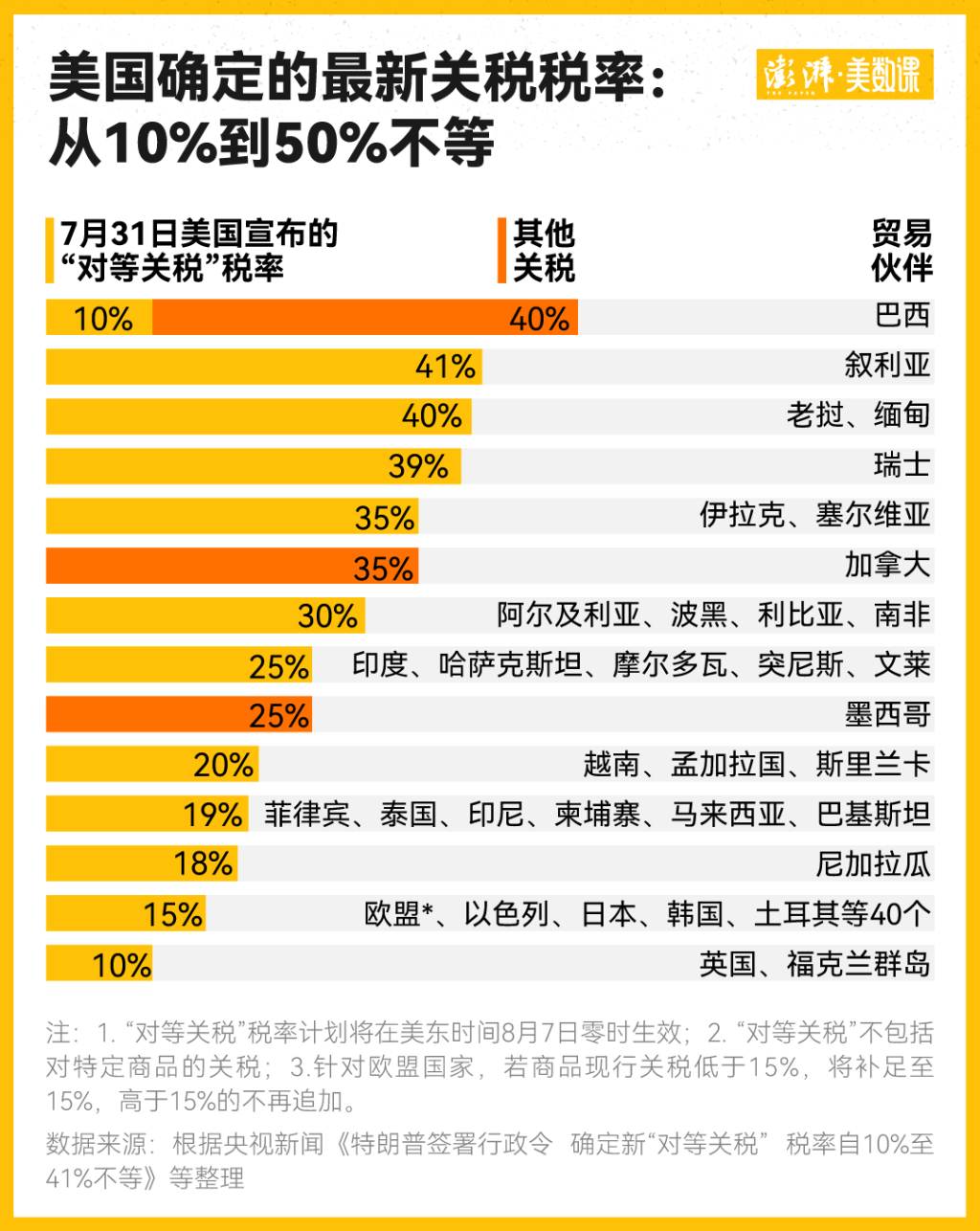

According to the latest announcement released by the US Customs, imported goods from the 69 countries or regions identified in Annex I of the executive order signed by Trump last week will be subject to an official "equivalent tariff" of 10% to 41% starting from 00:00 Eastern Time on August 7, 2025.

In addition to "equivalent tariffs," the largest trading partners of the United States, such as Mexico and Canada, have also been subject to additional tariffs of 25% and 35%, respectively. In addition, although Brazil is subject to a minimum "equivalent tariff" of 10%, the United States will impose an additional 40% tariff on Brazil from August 6th, bringing its total tax rate to 50%. The reason for this 40% tariff is to pressure Brazil to stop the judicial investigation against its former president Bolsonaro.

After announcing the so-called "equivalent tariffs" for the first time in April this year, Trump has twice postponed the implementation of the tariff plan, but the possibility of further postponement this time is not high.

According to a report by CCTV News on August 4th, US Trade Representative Greer stated that the new round of tariffs imposed by US President Trump on multiple countries last week is "basically set" and will not be adjusted in the current negotiations, including a 35% tariff on goods imported from Canada, a 50% tariff on Brazil, a 25% tariff on India, and a 39% tariff on Switzerland.

'Equivalent tariffs' will ultimately be paid by American consumers

At the beginning of Trump's tariff policy announcement, many companies chose to absorb the additional tariff costs on their own in order to maintain market share.

For example, Japanese cars, which account for 28.3% of Japan's total exports to the United States, showed no significant fluctuations in their prices in the first half of this year. But according to statistics from the Bank of Japan, the prices of cars exported from Japan to the North American market fell by 17.7% from March to May this year, which means that the cost of tariff increases is mainly borne by companies alone.

But there are increasing signs that the tariffs imposed by President Trump are gradually being passed on to consumers as the means by which businesses can maintain price stability are approaching their limits.

In addition to Wal Mart, the US retail giant, Mattel and Hasbro, the toy manufacturer, had previously warned that tariffs would drive up prices, P&G, which produces household products such as washing powder, diapers and toilet paper, also said that it planned to raise prices for about a quarter of US products by 2.5% on average from August.

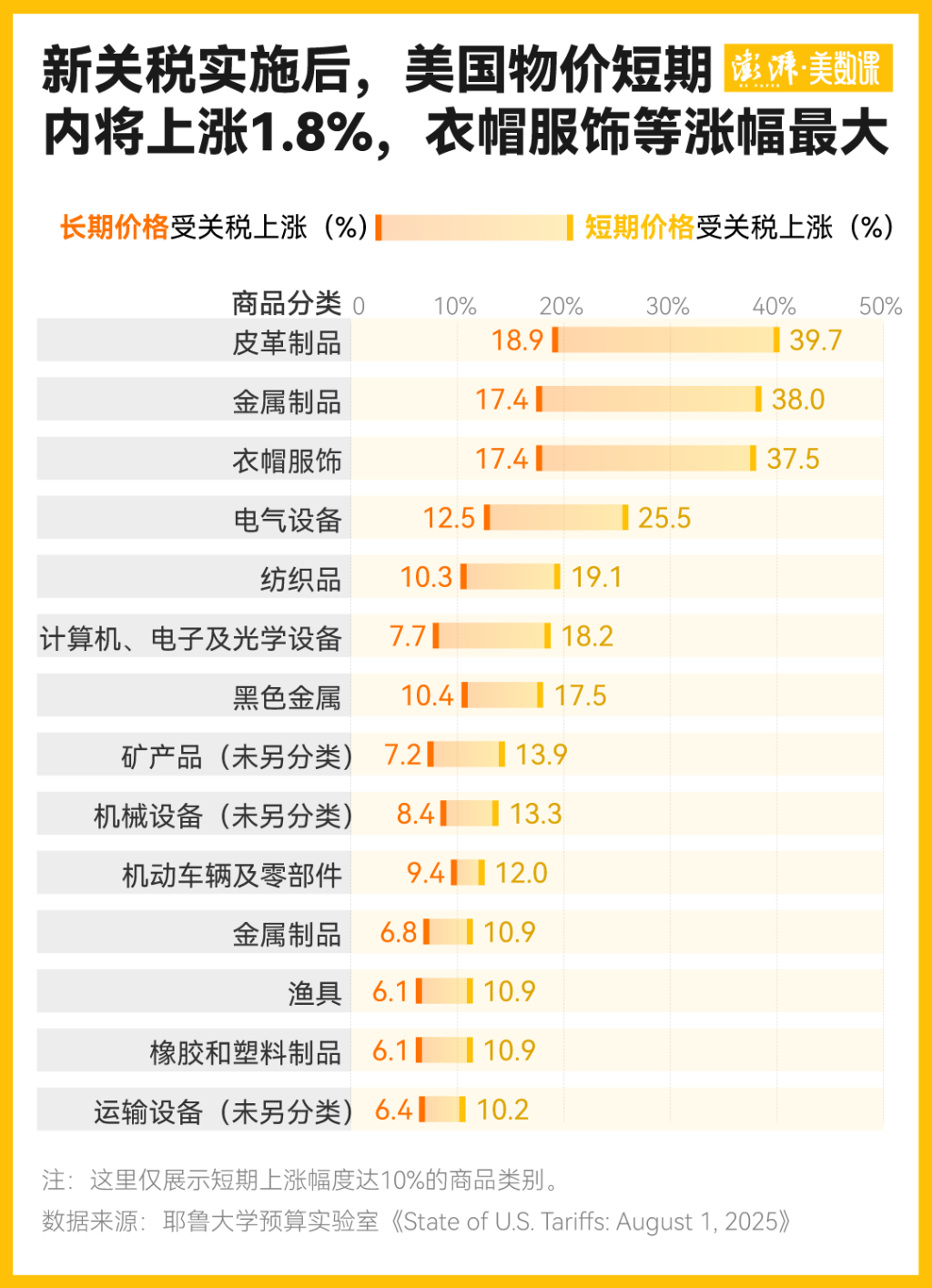

The upcoming implementation of 'equivalent tariffs' may further force American retailers to raise product prices. According to the Budget Lab at Yale University, prices in the United States are expected to rise by 1.8% in the short term, which is equivalent to an average loss of $2400 per American household by 2025 (approximately RMB 17200).

If we further divide it into goods that the United States highly relies on imports, the price fluctuations will be even more severe. According to calculations from the Yale University Budget Lab, in the short term, shoe and clothing prices may rise by 40% and 38% respectively. In the long run, the increase will gradually narrow, but still reach as high as 19% and 17%.

Richard Westenberger, Chief Financial Officer of Carter's, an American children's clothing manufacturer, said in a conference call with analysts on July 25th, "We have no intention of operating a business with lower profit margins, especially due to tariffs. If this is a permanent increase in our cost structure, we must find a way to absorb this cost

For example, for computers, which are also goods that the United States relies on imports, the Yale University Budget Laboratory estimates that if the "equivalent tariffs" are implemented as scheduled, it may lead to a short-term increase of 18.2% and a long-term increase of 7.7% in the prices of computers, electronics, and optical equipment. According to CCTV News, CNN cited data from the US Department of Commerce that computer prices in the United States have risen by nearly 5% year-on-year in June this year due to the US imposing high tariffs on multiple major importing countries.

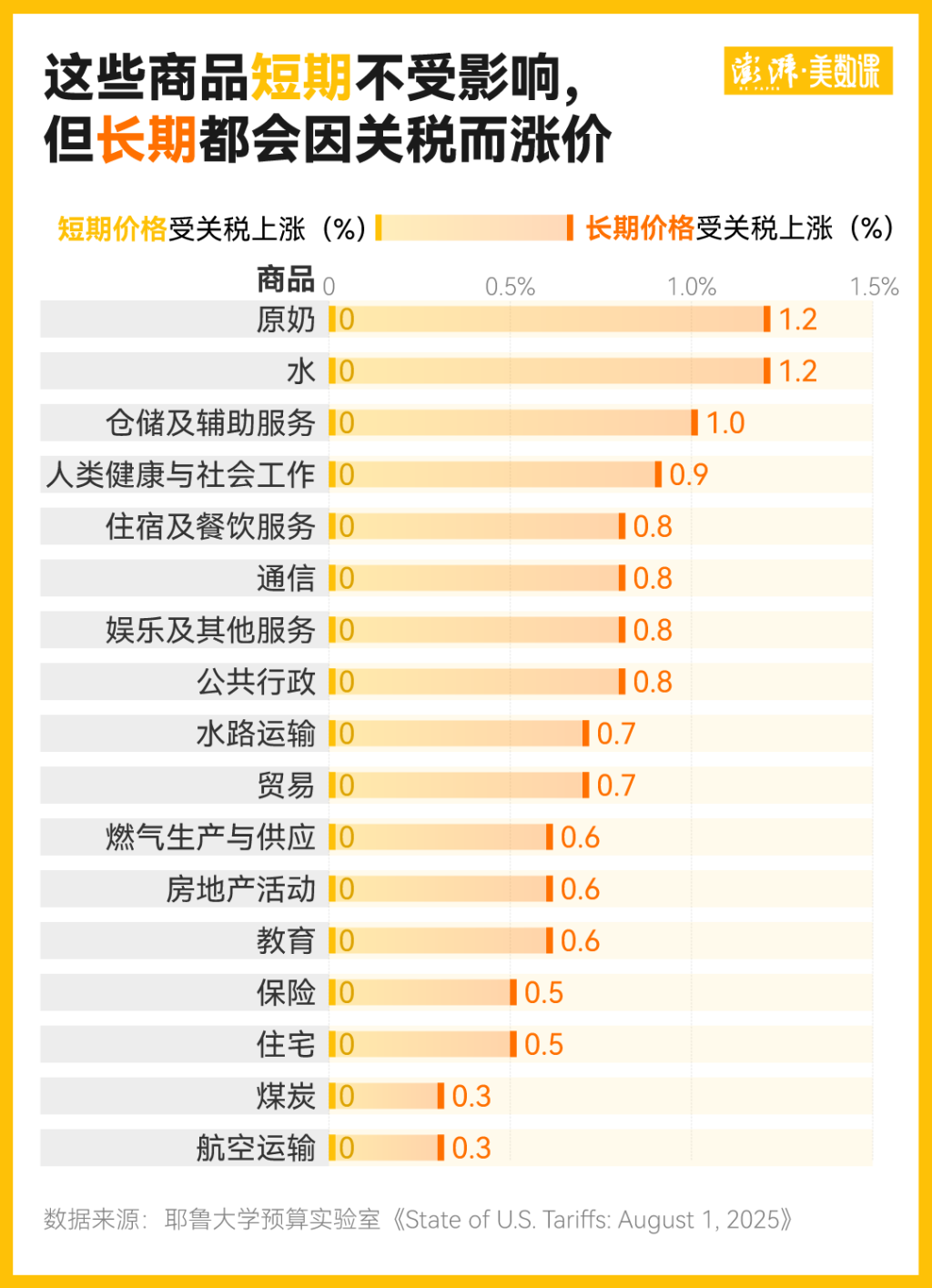

Data from the Yale University Budget Lab also shows that although some goods will not be affected by the "equivalent tariff" policy in the short term, the price increase of other goods will indirectly push up the prices of these goods. This is because if tariffs are targeted at upstream resource goods, there is a possibility that tariffs may shift towards finished products.

Yale University team warns: tariffs will hurt US economy

The impact of tariffs is not just about price increases.

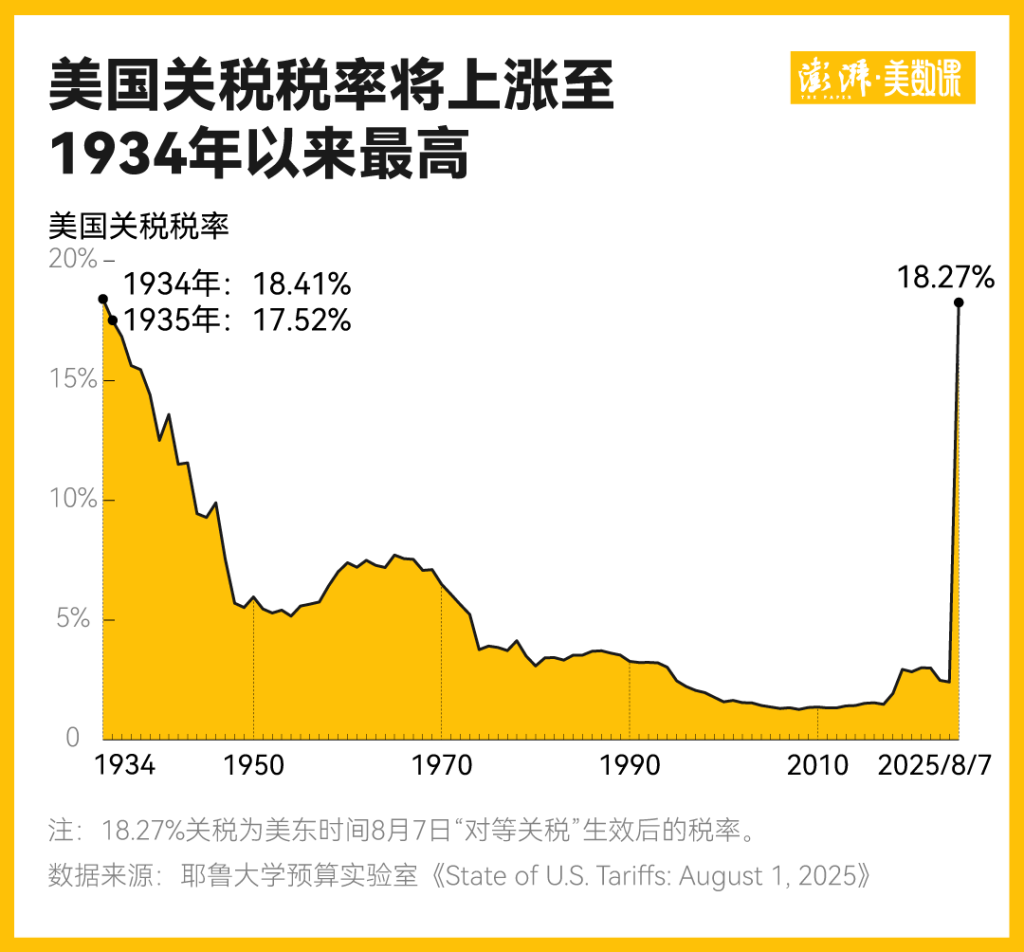

According to calculations from the Yale University Budget Lab, as a new round of so-called "equivalent tariffs" policy is officially implemented on August 7th, the overall effective average tariff rate faced by American consumers will climb to 18.3%, a historic high since 1934 and significantly higher than the 2.4% level in 2024 before Trump's second presidential term.

The laboratory believes that this will increase costs for American consumers and businesses and exacerbate inflation.

According to calculations from the Yale University Budget Lab, under the impact of the new tariffs, the annual real GDP growth rate of the United States in 2025 and 2026 will decrease by 0.5 percentage points. By the end of 2025, the US unemployment rate is expected to rise by 0.3 percentage points due to the impact of tariffs, and further increase by 0.7 percentage points by the end of 2026.

Ernie Tedeschi, director of economics at Yale University's Budget Lab, said that a 1.8% increase may seem "insignificant," but the Fed's annual inflation target is 2%. This means that the inflation level faced by the United States is almost twice as high as the originally expected target.

On July 30th, Federal Reserve Chairman Powell stated at a press conference after the interest rate meeting that some commodity prices have already reflected the impact of tariffs, but the impact of tariffs on overall inflation remains to be observed. Currently, it is estimated that 30% to 40% of core inflation comes from tariffs. He warned that the impact of tariffs could be "short-lived", but could also trigger "more lasting" inflationary changes.

On August 7th, whether the new US tariffs will be implemented or not, the world is holding its breath.

Contact

Leave your information and we will contact you.