Liu Qiangdong takes action, JD Logistics enters the Korean market

Created on 2025.06.03

1. JD Logistics enters the Korean market

JD's philosophy for doing business overseas is to prioritize logistics.

Recently, it has been reported that JD Logistics is launching a large-scale recruitment campaign at its Seoul headquarters in South Korea, including key positions such as customs clearance specialist, logistics system construction manager, logistics operations specialist, IT project manager, and marketing.

JD Logistics Enters the Korean Market Source: Newsis

At the same time, JD Logistics has completed two self-operated logistics centers in South Korea, located in Lichuan and Incheon, which can provide third-party logistics and integrated supply chain solutions, and offer customers in Seoul and some parts of the capital region with the fastest delivery service of 12 hours.

At present, JD Lichuan Warehouse has reached a cooperation agreement with well-known Korean pet food e-commerce platform Pet Flanders, while Renchuan Warehouse has reached a cooperation agreement with local Korean beauty brands and a well-known American consumer brand. More than 60% of domestic Korean orders can be delivered on the same day in two overseas warehouses.

Although JD.com has only expanded its logistics business in South Korea, given its leading position in the domestic e-commerce market, some industry insiders speculate that this may be an important signal for JD.com to enter the South Korean e-commerce market.

Compared to Temu and AliExpress, which have already entered the market, JD.com is the first Chinese e-commerce platform to establish its own logistics infrastructure in South Korea.

Moreover, JD has strong capabilities and its global revenue far exceeds mainstream Korean platforms such as Coupang, SSG.com, and Gmarket. This means that even if these platforms have established efficient and complete logistics networks locally, JD.com may still rely on its logistics strength to compete for market share.

Taking the 2024 performance as an example, Coupang, the largest e-commerce platform in South Korea, had sales of KRW 41 trillion (approximately USD 29.972 billion) and operating profit of KRW 602.3 billion (approximately USD 440 million). JD's net revenue for the same period was $158.8 billion, more than five times that of Coupang, with an operating profit of $6 billion.

Of course, as an overseas platform, if JD.com wants to gain a certain share of the e-commerce market, it will inevitably have to put in more effort to integrate into the local market.

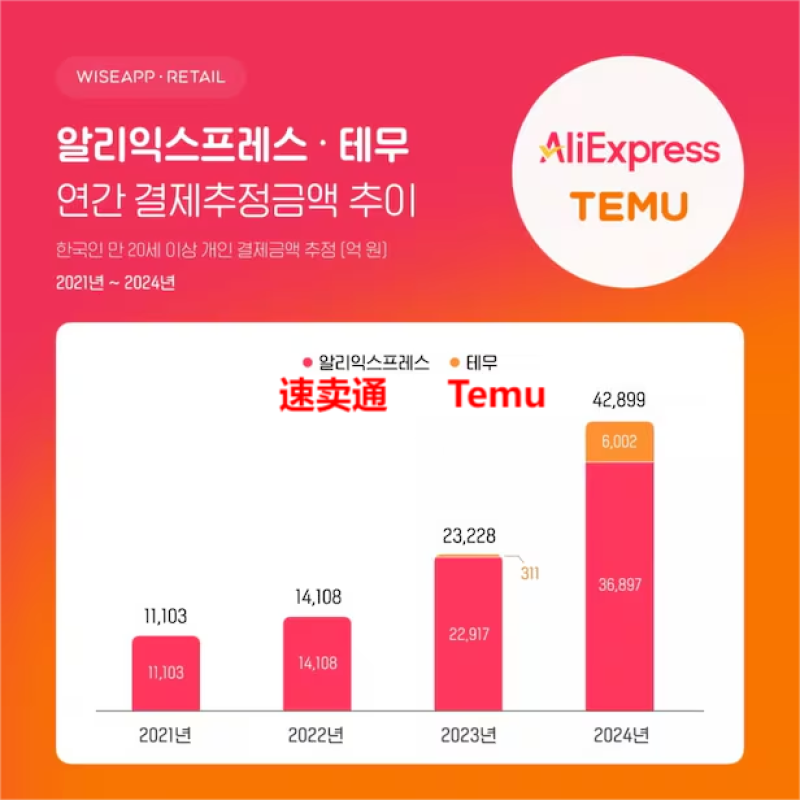

In addition, as a newcomer, if JD.com enters the Korean market, it will also face competitive pressure from Temu and AliExpress. According to a research report by WiseApp Retail, the total sales of Temu and AliExpress in Korea exceeded 4 trillion Korean won (approximately 2.75 billion US dollars) in 2024, an increase of 85% compared to the same period last year.

AliExpress Temu's sales surge in South Korea. Source: biz.chosun

Moreover, Temu and AliExpress have maintained high monthly active users in Korea, with AliExpress having approximately 9.124 million monthly active users and Temu having approximately 8.234 million monthly active users as of December last year.

Obviously, JD has a long way to go before entering the Korean market, whether it is in logistics or e-commerce.

II. Accelerate global expansion

Apart from its business in South Korea, JD.com has been expanding its presence in other markets in an orderly manner in recent times. All these moves are clearly aimed at strengthening its overseas business.

In Southeast Asia, JD Logistics plans to build three new overseas warehouses this year, located in Malaysia and Vietnam. Additionally, it will launch two new international air routes from China to Southeast Asia to expand the coverage of JD International Express in the region.

JD's first overseas warehouse in Mexico has been put into operation. Source: JD Logistics Blackboard News

In Latin America, JD Logistics has just opened its first self-operated overseas warehouse in Mexico, mainly providing local fulfillment services for a well-known international fast fashion e-commerce giant, with the fastest delivery time being same-day. At the same time, JD Logistics will also cooperate with local Mexican enterprises to enhance the transportation capacity for large items.

According to JD's plan, by the end of this year, the area of JD Logistics' global overseas warehouses will be expanded by more than double, and with the use of intelligent equipment, the efficiency of some overseas supply chain services will be increased by more than three times, building a global "2-3 day delivery" distribution network.

Meanwhile, JD.com's retail business is also making significant progress overseas. In March, JD.com Group signed a cooperation agreement with the Union of European Football Associations, making JD.com the official e-commerce innovation partner of the UEFA Champions League.

In April, JD.com disclosed at an industry conference that its overseas retail business, Joybuy, will launch a recruitment drive for international and export-oriented brands in the baby and toy categories and conduct a small-scale user beta test in London.

Currently, Joybuy's product range covers popular categories such as home appliances, snacks and daily necessities, pet supplies, and beauty and personal care, including both domestic and international well-known brands. New users can enjoy promotional activities when placing orders, such as a £5 discount for orders over £10, free shipping, and discounts on specific products.

In addition, JD's independent retail brand ochama has also established a firm foothold in Europe. In the Netherlands, Germany, Belgium and France, ochama has over 900 pick-up points and offers full-category product delivery services to 24 European countries. It can be seen that JD's overseas business moves are becoming more frequent and its goals are very clear. Even though market competition is becoming increasingly fierce, JD has sufficient strength and confidence to face the challenges head-on. It is believed that in the near future, with the dual drive of retail and logistics, JD will also carve out a niche for itself overseas.

Contact

Leave your information and we will contact you.